As the first Private Equity firm focusing on Vietnam’s private sector, our depth of experience investing in Vietnam is unparalleled. With 46 private equity investments, we have been an early stage investor in many of Vietnam’s leading companies.

This nearly 25 years of investment experience in Vietnam equips us with unique institutional knowledge and relationships, which we believe equips us to make better investment decisions and add value more consistently. Please visit our History page for more on our history.

Mekong Capital has historically focused on investments in consumer sectors – we believe the most extensive track record of investments in leading retailers, consumer products and F&B in Vietnam. In recent years, we’ve increasingly allocated our resources to biotechnology, healthcare and agrotechnology. Please visit Sectors for more on our expertise by sector.

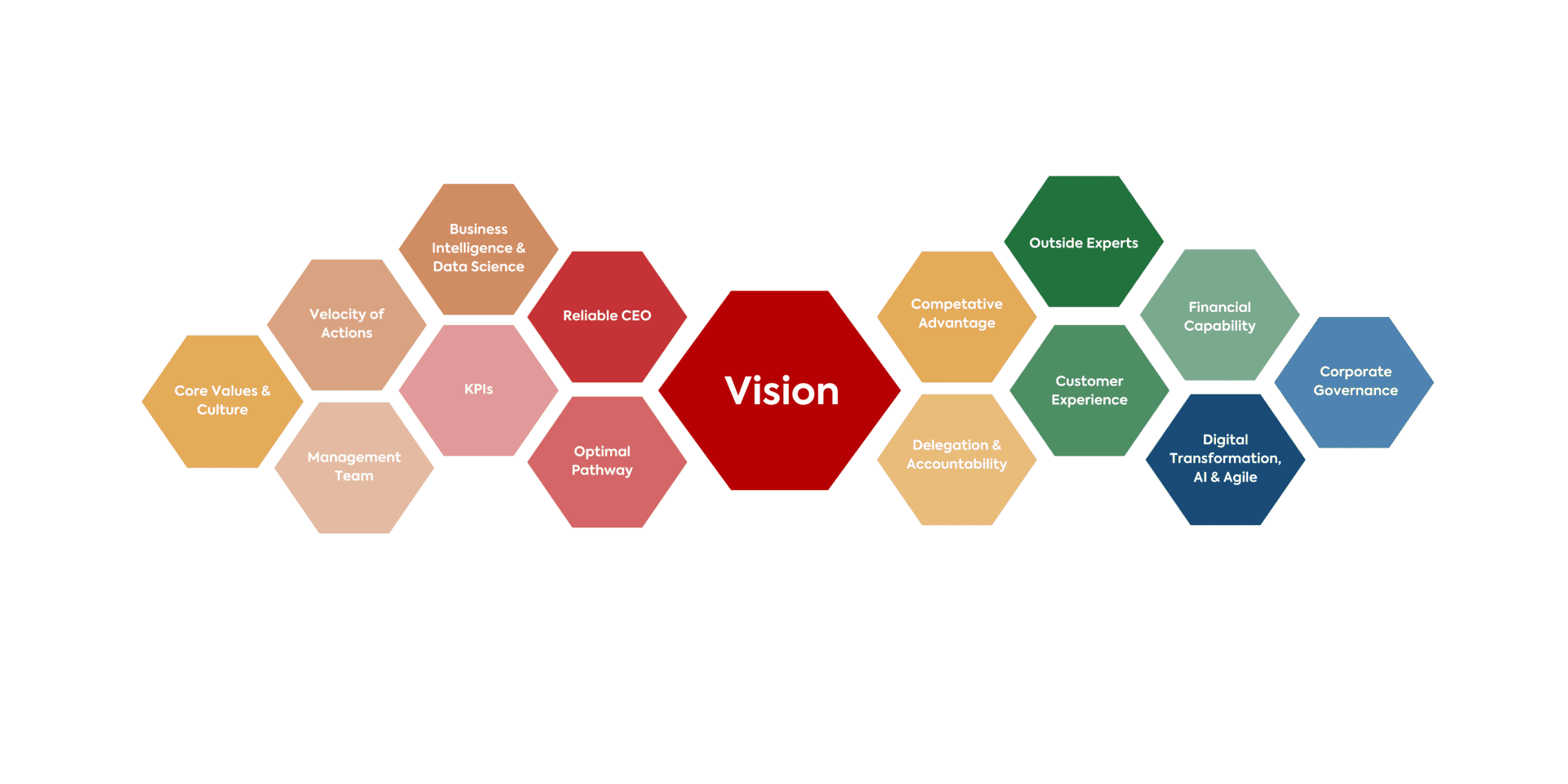

Our program for adding value post-investment, Vision Driven Investing, was built and refined based on our experience of what worked for our most successful investments – MobileWorld, Golden Gate, PNJ, FPT Corporation, Masan Consumer, Traphaco, F88 and others. This approach is statistically validated to be correlated with the performance of our investments, and has been the subject of a variety of case studies. Please visit our How We Add Value section for more on how we add value.

Having been active in Vietnam for nearly 25 years across so many leading Vietnamese companies, our extensive network of company founders, CEOs and senior managers, industry experts, and the investment community all enable us to leverage the best expertise and partners.

We proactively involve outside experts who can deliver game-changing value to our investees, including Non Executive Independent Directors on the Boards of our investee companies and advisors to our companies.