Our Funds

2019

Mekong Enterprise Fund IV

Mekong Enterprise Fund IV was launched in 2019 with US$246 million in committed capital, more than double its predecessor, Mekong Enterprise Fund III.

2015

Mekong Enterprise Fund III

Launched in May 2015 with US$112 million in committed capital, Mekong Enterprise Fund III was Mekong Capital's first fund to focus exclusively on Vietnamese consumer-driven sectors.

2007

Vietnam Azalea Fund

Vietnam Azalea Fund was launched in June 2007, focusing on companies that were expected to list on the stock exchange within 12 months of the initial investment.

2006

Mekong Enterprise Fund II

Based on our experience in the Mekong Enterprise Fund, Mekong Capital started to shift its focus towards the consumer sector with Mekong Enterprise Fund II, which was launched in June 2006 with $50 million in committed capital.

2002

Mekong Enterprise Fund

Given the opportunity to set up the first Fund in Vietnam to focus uniquely on investing in private companies, in 2002, Mekong Capital launched Mekong Enterprise Fund at $18.5 million in committed capital.

BTJ

Jewelry

Pizza 4P’s

Restaurant chainWhen MEF III divested in 2022, Pizza 4P’s grew from a chain of 8 restaurants in 2018 to a network of 27 restaurants in Vietnam and Cambodia, representing growth of more than three times. During this rapid growth, Pizza 4P’s has successfully maintained its uniquely high-quality standards and commitment to delivering ‘Wow’ dining experiences to its customers. As a validation of its stronghold in customer experience, Pizza 4P’s has been nominated as the Best Pizza in Vietnam and Cambodia as part of the Asia’s Best Awards 2022 by the well-known international magazine Travel + Leisure Asia.

Intresco

Real estateIn July 2016, Vietnam Azalea Fund completed the sale of all of its shares in Intresco, that specializes in the construction, development, sale and lease of residential and commercial real estate. The Fund originally invested in Intresco in 2008.

Traphaco

PharmaceuticalIn November 2017, Vietnam Azalea Fund completed the sale of all of its shares in Traphaco, a vertically-integrated pharmaceutical company specializing in the development, marketing and distribution of Vietnamese traditional medicines. The Fund originally invested in Traphaco in December 2007

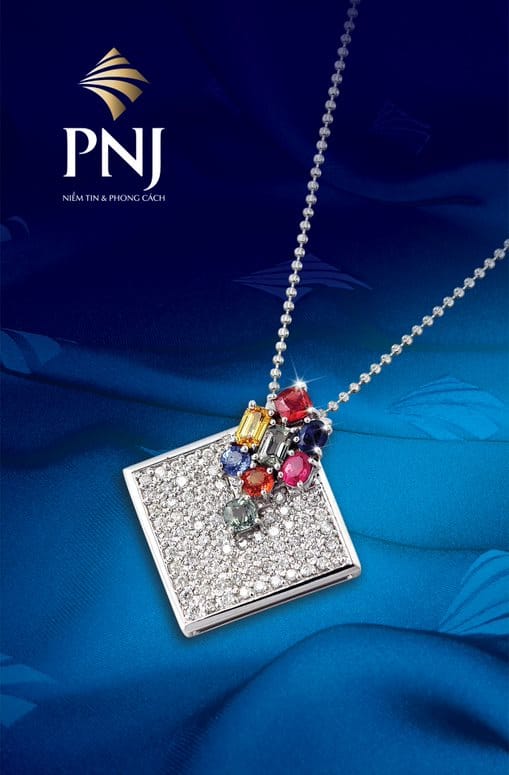

Phu Nhuan Jewelry

JewelryIn November 2016, Vietnam Azalea Fund completed the sale of all of its shares in PNJ, a jewelry manufacturer and the largest jewelry retailer in Vietnam. The Fund originally invested in PNJ in December 2007.

Loc Troi Group

AgricultureIn September 2017, Vietnam Azalea Fund completed the sale of all of its shares in Loc Troi Group (LT Group), the leading distributor and a manufacturer of crop protection chemicals (CPC) in Vietnam. The Fund originally invested in Loc Troi Group in December 2008.

Masan Food Corporation

FMCGIn November 2010, the Fund divested 100% of its shares through a negotiated block transaction on the OTC market. The Fund originally invested into Masan Food, the leading maker of branded sauce and seasoning products and a major player in the large instant noodles market, in May 2009.

Nam Long

Real estateIn June 2016, Vietnam Azalea Fund completed the sale of all of its shares in Nam Long, the leading developer of affordable housing in Vietnam. The Fund originally invested in Nam Long in 2010.

FPT Corporation

IT & TelecomIn April 2016, Vietnam Azalea Fund completed the sale of all of its shares in FPT Corporation, the leading information technology/telecom conglomerate in Vietnam. The Fund originally invested in FPT Corporation in 2011.

International Consumer Product (ICP)

FMCGIn February 2011, Mekong Enterprise Fund II Ltd has successfully divested 100% of its investment in International Consumer Products (“ICP”) to a strategic investor, Marico Ltd., a publicly listed consumer products company based in India. The Fund had invested in ICP in October, 2006.

Ngo Han

ManufacturingIn October 2013, Mekong Capital completed the sale of all of Mekong Enterprise Fund and Mekong Enterprise Fund II’s shares in Ngo Han, Vietnam’s leading magnet wire producer. Mekong’s Funds originally invested in Ngo Han in April 2004.

Venture International (VIVCO)

ManufacturingIn April 2014, Mekong Enterprise Fund II completed the sale of all of its shares in Venture International, Vietnam’s leading industrial workwear manufacturer, in a trade sale to a strategic investor. The Fund originally invested in Venture International in September 2007.

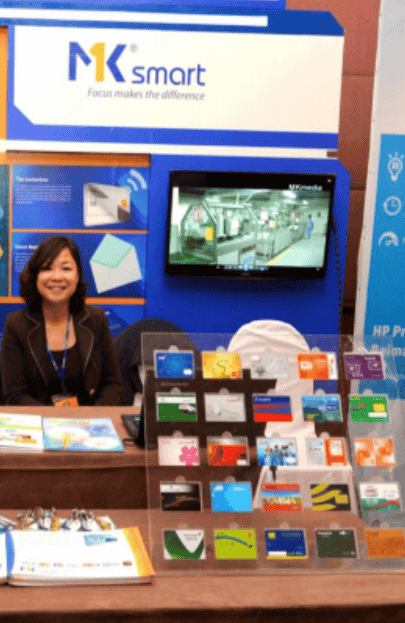

MK Smart

ManufacturingIn September 2013, Mekong Capital completed the sale of all of Mekong Enterprise Fund II’s shares in MK Smart, which is the only local card manufacturer in Vietnam. The Fund originally invested in MK Smart in December 2007.

Maison

Retail chainIn June 2010, Mekong Enterprise Fund II completed the sale of all of its shares in Maison, a chain of high-end fashion stores. The Fund originally invested in Mai Son Joint Stock Company in March 2008.

Golden Gate

Restaurant chainIn August 2014, Mekong Enterprise Fund II completed the sale of all of its shares in Golden Gate, one of the leading restaurant chain operators in Vietnam. The Fund originally invested in Golden Gate in April 2008. The Fund achieved a 9x return on its investment over the 6 ½ year holding period, driven by the expansion of Golden Gate from one brand with 7 restaurant locations at the time of the investment to more than 10 brands with around 75 restaurant locations by the time of the exit.

Mekong’s investment in Golden Gate was the subject of a case study written by INSEAD and published in March 2016. The case study is available here: PE in Emerging Markets: Can Mekong Capital’s Operating Advantage Boost the Value in its Exit from Golden Gate Restaurants?

Digiworld

IT & TelecomIn September 2013, Mekong Capital completed the sale of all of Mekong Enterprise Fund II’s shares in Digiworld, the number three IT distribution company (non retailer) in Vietnam. The Fund originally invested in Digiworld in December 2008.

Vietnam Australia International School

EducationIn 2017, Mekong Enterprise Fund II completed the sale of all of its shares in Vietnam Australia International School (“VAS”), the leading private bilingual dual-curriculum K-12 education service provider in Vietnam. The Fund originally invested in VAS in April 2010.

Mobile World

Retail chainIn January 2018, Mekong Enterprise Fund II completed the sale of all of its shares in Mobile World after a 10.5 year holding period.

Mobile World has established itself as Vietnam’s market leader in mobile device retail through its Thegioididong.com store network, and consumer electronics and household appliance retail under the Dienmayxanh store network. The company is rapidly expanding its 3rd retail concept, the mini-supermarket chain Bachhoaxanh, in Ho Chi Minh City.

The Fund originally invested in Mobile World in May 2007 when the company operated 7 stores. By the time the Fund completed its exit in January 2018, the company was operating more than 2,000 store locations. This tremendous growth led to a 57x return multiple for the Fund over the lifetime of the investment.”

Mobile World is the subject of a 3-part case study written by the National University of Singapore (NUS) and published in the Ivey Publishing case study catalog in May 2018. The 3 cases are available at Ivey Publishing’s website at the following links:

- Mekong Capital and Mobile World (A): Growing a US$100 Million Company In Vietnam

- Mekong Capital and Mobile World (B): Bob Willett

- Mekong Capital and Mobile World (C): Venturing into New Countries and Segments

Asia Chemical Corporation

ManufacturingIn 2018, Mekong Enterprise Fund II completed the sale of all of its shares in Asia Chemical Corporation (“ACC”), a leading distributor of high-quality specialty ingredients, chemicals, non-oil related commodities and other materials, sourcing from worldwide suppliers and selling to a wide range of leading enterprises in Vietnam. The Fund originally invested in ACC in March 2011.

AA Corporation (AA)

ManufacturingIn October 2011, Mekong Enterprise Fund divested 100% of its investment in AA Corporation to an investment fund. In recent years, AA built up their senior management team, expanded its customer base significantly in the Middle East, and delivered increasingly strong financial performance. The Fund originally invested in AA in March 2003 and held the investment for more than 8 years.

Tan Dai Hung Plastics

ManufacturingIn August 2009, Mekong Enterprise Fund has completed the sales of its shares in Tan Dai Hung Plastics Joint Stock Company. The Fund originally invested in Tan Dai Hung in March 2003, which was the Fund’s first investment. We have worked with them to prepare for a successful listing in November 2007.

Lac Viet Computing Corporation

IT & TelecomIn April 2012, Mekong Capital completed the sale of all of Mekong Enterprise Fund’s shares in Lac Viet Computing Corporation, a leading IT services provider for small and medium sized companies in Vietnam. The Fund originally invested in Lac Viet in July 2003.

Ngo Han

ManufacturingIn October 2013, Mekong Capital completed the sale of all of Mekong Enterprise Fund and Mekong Enterprise Fund II’s shares in Ngo Han, Vietnam’s leading magnet wire producer. Mekong’s Funds originally invested in Ngo Han in April 2004.

Nam Hoa Production and Trading Corporation

ManufacturingIn August 2012, Mekong Capital completed the sale of all of Mekong Enterprise Fund’s shares in Nam Hoa Production and Trading Corporation, a leading Vietnamese manufacturer of wooden toys intended for children aged between 1 to 10 years old. The Fund originally invested in Nam Hoa in June 2004.

Minh Phuc Printing & Packaging Company

ManufacturingIn February 2011, Mekong Capital completed the divestment of Mekong Enterprise Fund’s entire position in Minh Phuc Printing and Packaging Company (“Minh Phuc”) to a Vietnamese strategic investor. The Fund originally invested in Minh Phuc in November 2004.

Duc Thanh

ManufacturingIn Aug 2009, Mekong Capital has completed the sale of Mekong Enterprise Fund’s investment in Duc Thanh Wood Processing Joint Stock Company (“Duc Thanh”) to a Vietnamese strategic investor. The Fund originally invested in Duc Thanh in February 2005.

Minh Hoang Garment

ManufacturingIn September 2018, Mekong Enterprise Fund completed the sale of all of its shares in Minh Hoang, one of Vietnam’s leading producers of sports apparel, active-wear and outerwear, supplying some of the top brands worldwide. The Fund originally invested in Minh Hoang in March 2005.

Saigon Gas

ManufacturingIn December 2008, Mekong Enterprise Fund sold its stake in Saigon Gas to the French oil and gas giant, Total Group, who acquired 100% of the company concurrently. This was Mekong Capital’s first divestment. Foreseeing the consolidation trend in Vietnam’s LPG market and understanding the industry dynamics, we worked closely with the company to make it attractive to strategic buyers, focusing on its distribution network, strong brand, and transparency in financial reporting. As a result, MEF managed to complete the exit at attractive valuations, even in the midst of a global financial crisis.

Goldsun Join Stock Company

ManufacturingIn 2012, Mekong Capital has completed the sale of Mekong Enterprise Fund’s investment in Goldsun Joint Stock Company. The Fund originally invested in Goldsun in December 2005.