PAST INVESTMENTS

Cultivating from our experience

We’ve found selling investments to be particularly easy, especially for well-managed companies that have implemented most or all of Vision Driven Investing. We have completed 28 full exits, through a full range of exit routes: trade sales to strategic investors, sale to other PE funds, listing on the stock market and selling to other public equity funds, or sometimes sales back to the founders of the companies.

BTJ

Jewelry

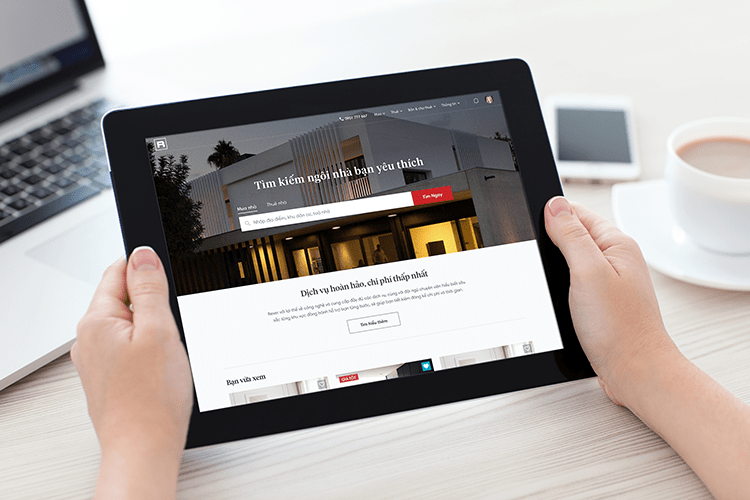

Rever

Property TechnologyIn September 2024, Mekong Enterprise Fund IV (MEF IV) has divested 100% of its investment in Rever, one of the pioneering proptech companies in Vietnam and an Online-to-Offline (O2O) real estate brokerage model.

The Fund originally invested into Rever in August 2021.

Pizza 4P’s

Restaurant chainWhen MEF III divested in 2022, Pizza 4P’s grew from a chain of 8 restaurants in 2018 to a network of 27 restaurants in Vietnam and Cambodia, representing growth of more than three times. During this rapid growth, Pizza 4P’s has successfully maintained its uniquely high-quality standards and commitment to delivering ‘Wow’ dining experiences to its customers. As a validation of its stronghold in customer experience, Pizza 4P’s has been nominated as the Best Pizza in Vietnam and Cambodia as part of the Asia’s Best Awards 2022 by the well-known international magazine Travel + Leisure Asia.

Mobile World

Retail chainIn January 2018, Mekong Enterprise Fund II completed the sale of all of its shares in Mobile World after a 10.5 year holding period.

Mobile World has established itself as Vietnam’s market leader in mobile device retail through its Thegioididong.com store network, and consumer electronics and household appliance retail under the Dienmayxanh store network. The company is rapidly expanding its 3rd retail concept, the mini-supermarket chain Bachhoaxanh, in Ho Chi Minh City.

The Fund originally invested in Mobile World in May 2007 when the company operated 7 stores. By the time the Fund completed its exit in January 2018, the company was operating more than 2,000 store locations. This tremendous growth led to a 57x return multiple for the Fund over the lifetime of the investment.”

Mobile World is the subject of a 3-part case study written by the National University of Singapore (NUS) and published in the Ivey Publishing case study catalog in May 2018. The 3 cases are available at Ivey Publishing’s website at the following links:

- Mekong Capital and Mobile World (A): Growing a US$100 Million Company In Vietnam

- Mekong Capital and Mobile World (B): Bob Willett

- Mekong Capital and Mobile World (C): Venturing into New Countries and Segments

International Consumer Product (ICP)

FMCGIn February 2011, Mekong Enterprise Fund II Ltd has successfully divested 100% of its investment in International Consumer Products (“ICP”) to a strategic investor, Marico Ltd., a publicly listed consumer products company based in India. The Fund had invested in ICP in October, 2006.

Golden Gate

Restaurant chainIn August 2014, Mekong Enterprise Fund II completed the sale of all of its shares in Golden Gate, one of the leading restaurant chain operators in Vietnam. The Fund originally invested in Golden Gate in April 2008. The Fund achieved a 9x return on its investment over the 6 ½ year holding period, driven by the expansion of Golden Gate from one brand with 7 restaurant locations at the time of the investment to more than 10 brands with around 75 restaurant locations by the time of the exit.

Mekong’s investment in Golden Gate was the subject of a case study written by INSEAD and published in March 2016. The case study is available here: PE in Emerging Markets: Can Mekong Capital’s Operating Advantage Boost the Value in its Exit from Golden Gate Restaurants?

Masan Food Corporation

FMCGIn November 2010, the Fund divested 100% of its shares through a negotiated block transaction on the OTC market. The Fund originally invested into Masan Food, the leading maker of branded sauce and seasoning products and a major player in the large instant noodles market, in May 2009.

Vietnam Australia International School

EducationIn 2017, Mekong Enterprise Fund II completed the sale of all of its shares in Vietnam Australia International School (“VAS”), the leading private bilingual dual-curriculum K-12 education service provider in Vietnam. The Fund originally invested in VAS in April 2010.

Nam Long

Real estateIn June 2016, Vietnam Azalea Fund completed the sale of all of its shares in Nam Long, the leading developer of affordable housing in Vietnam. The Fund originally invested in Nam Long in 2010.

FPT Corporation

IT & TelecomIn April 2016, Vietnam Azalea Fund completed the sale of all of its shares in FPT Corporation, the leading information technology/telecom conglomerate in Vietnam. The Fund originally invested in FPT Corporation in 2011.

Phu Nhuan Jewelry

JewelryIn November 2016, Vietnam Azalea Fund completed the sale of all of its shares in PNJ, a jewelry manufacturer and the largest jewelry retailer in Vietnam. The Fund originally invested in PNJ in December 2007.

Loc Troi Group

AgricultureIn September 2017, Vietnam Azalea Fund completed the sale of all of its shares in Loc Troi Group (LT Group), the leading distributor and a manufacturer of crop protection chemicals (CPC) in Vietnam. The Fund originally invested in Loc Troi Group in December 2008.