少年时期

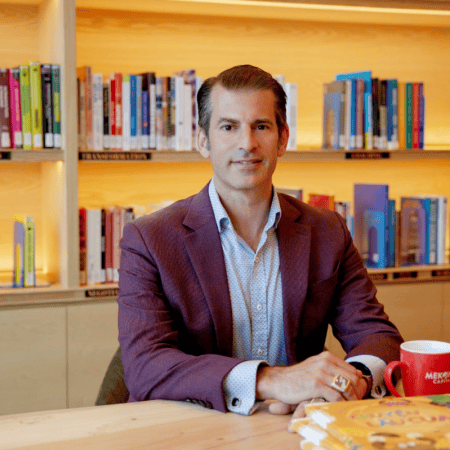

Chris Freund 在美国伊利诺伊州芝加哥长大,就读于芝加哥拉丁学校(The Latin School of Chicago),随后进入加州大学圣克鲁兹分校(UCSC)学习,主修心理学、经济学与东方宗教。

从青少年时期起,Chris 就对佛教与灵性议题产生浓厚兴趣。1992 年,他参加了由安提阿大学(Antioch University)组织、在印度菩提伽耶(Bodh Gaya)举行的培训项目。课程结束后,Chris 用 6 个月时间周游亚洲,第一站是在越南停留一个月。Chris 立刻爱上了这个国家,并决心大学毕业后再次回到越南。

1994 年 2 月 3 日,美国解除对越南的贸易与投资禁运后,越南的外资投资、贸易以及外国人在越南的职业机会大门随之敞开。怀着在越南生活与工作的热情,1994 年年中,Chris 暂停学业,前往胡志明市开展一项实习项目,研究投资机会。彼时,Templeton 刚刚在纽约证券交易所(NYSE)推出越南投资基金。1995 年初毕业后,Chris 加入 Templeton,成为该公司在越南的第一名员工,负责设立办公室并在当地市场寻找投资机会。

1998 年,在完成对若干与国有企业合资项目的三笔投资、且亚洲金融危机爆发的背景下,Templeton 关闭了越南办公室,并将团队迁往新加坡。在新加坡,Chris 出任投资组合经理,主要分析并提出对台湾与以色列科技公司的投资建议,同时继续监督 Templeton 在越南的部分投资。通过结识多家成功企业的创始人与 CEO,Chris 深受启发,萌生了亲自创业的愿望。出于重返越南的强烈渴望,Chris 酝酿并提出一种更直接、能够创造更高附加值的先锋型投资模式——这将远超他此前所见其他投资者的做法。